Hydrogen and Ammonia

Learn more about our current hydrogen and ammonia activities across the globe.

-

US$5 billion

Targeted investment in new energy products and lower carbon services by 2030 [1][2]

-

US$2.5 billion

Cumulative spend since 2021 on new energy products and lower-carbon services [3][4][5][6]

-

4

Expected end uses: heavy duty transport, power, shipping and aviation, and industrials and chemicals

[1] Includes pre-RFSU spend on new energy products and lower carbon services that can help our customers decarbonise by using these products and services. It is not used to fund reductions of Woodside’s net equity Scope 1 and 2 emissions which are managed separately through asset decarbonisation plans.

[2] Scope 3 targets are subject to commercial arrangements, commercial feasibility, regulatory and Joint Venture approvals, and third-party activities (which may or may not proceed). Individual investment decisions are subject to Woodside’s investment targets. Not guidance. Potentially includes both organic and inorganic investment.

[3] Cumulative spend against the investment target at the end of 2024 includes 80% of the total $2,350 million for the Beaumont New Ammonia Project acquisition. The remaining 20% will be paid at Project completion.

[4] Includes pre-RFSU spend on new energy products and lower carbon services that can help our customers decarbonise by using these products and services. It is not used to fund reductions of Woodside’s net equity Scope 1 and 2 emissions which are managed separately through asset decarbonisation plans.

[5] Scope 3 targets are subject to commercial arrangements, commercial feasibility, regulatory and Joint Venture approvals, and third-party activities (which may or may not proceed). Individual investment decisions are subject to Woodside’s investment targets. Not guidance. Potentially includes both organic and inorganic investment.

[6] New energy project progress (which includes new energy products and lower carbon services) is subject to commercial arrangements, commercial feasibility, regulatory and Joint Venture approvals, and third party activities (which may or may not proceed). Individual investment decisions are subject to Woodside’s investment targets. Not guidance. Potentially includes both organic and inorganic investment.

[1] Woodside uses this term to describe the characteristic of having lower levels of associated potential GHG emissions when compared to historical and/or current conventions or analogues, for example relating to an otherwise similar resource, process, production facility, product or service, or activity.

[2] Production of lower-carbon ammonia is conditional on supply of carbon abated hydrogen and ExxonMobil’s CCS facility becoming operational.

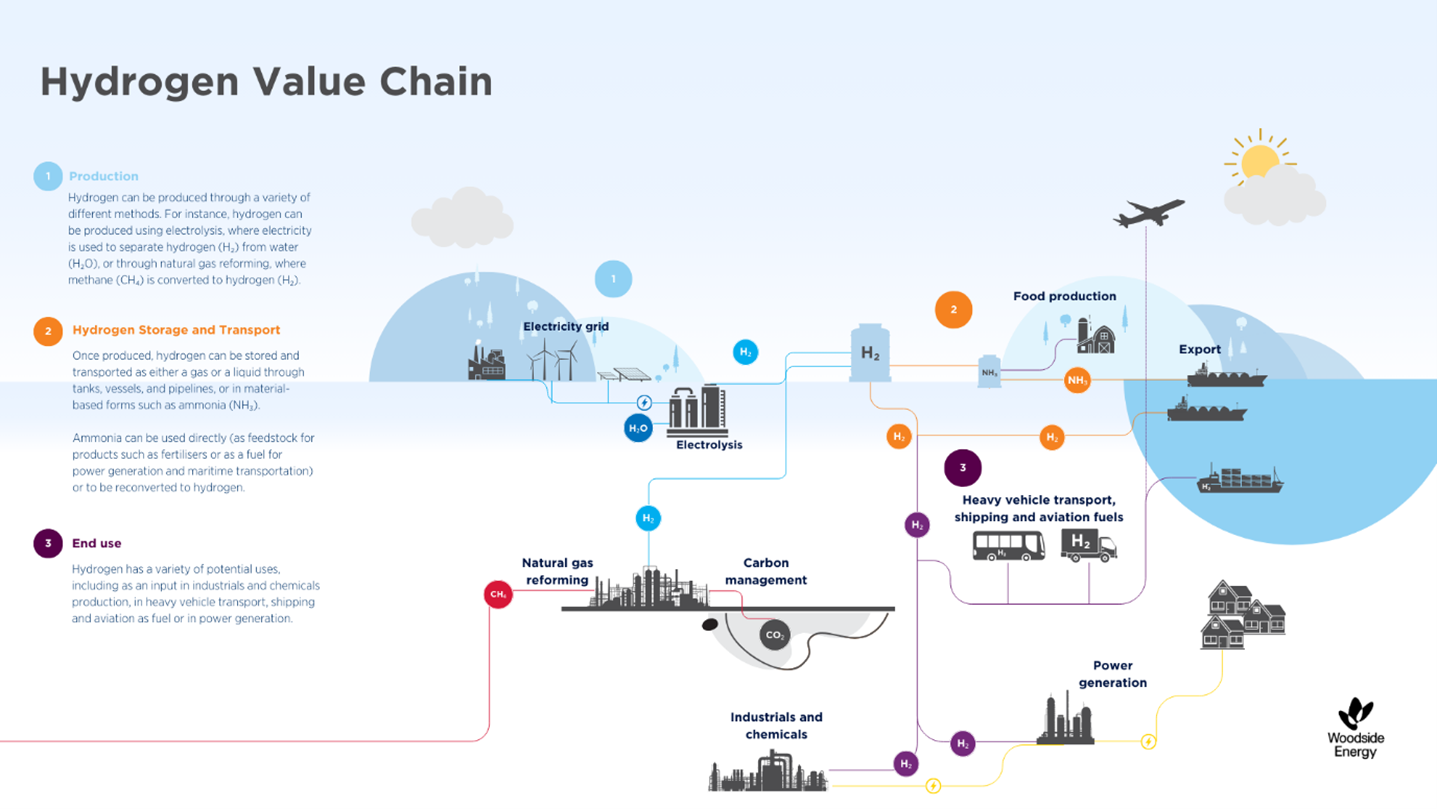

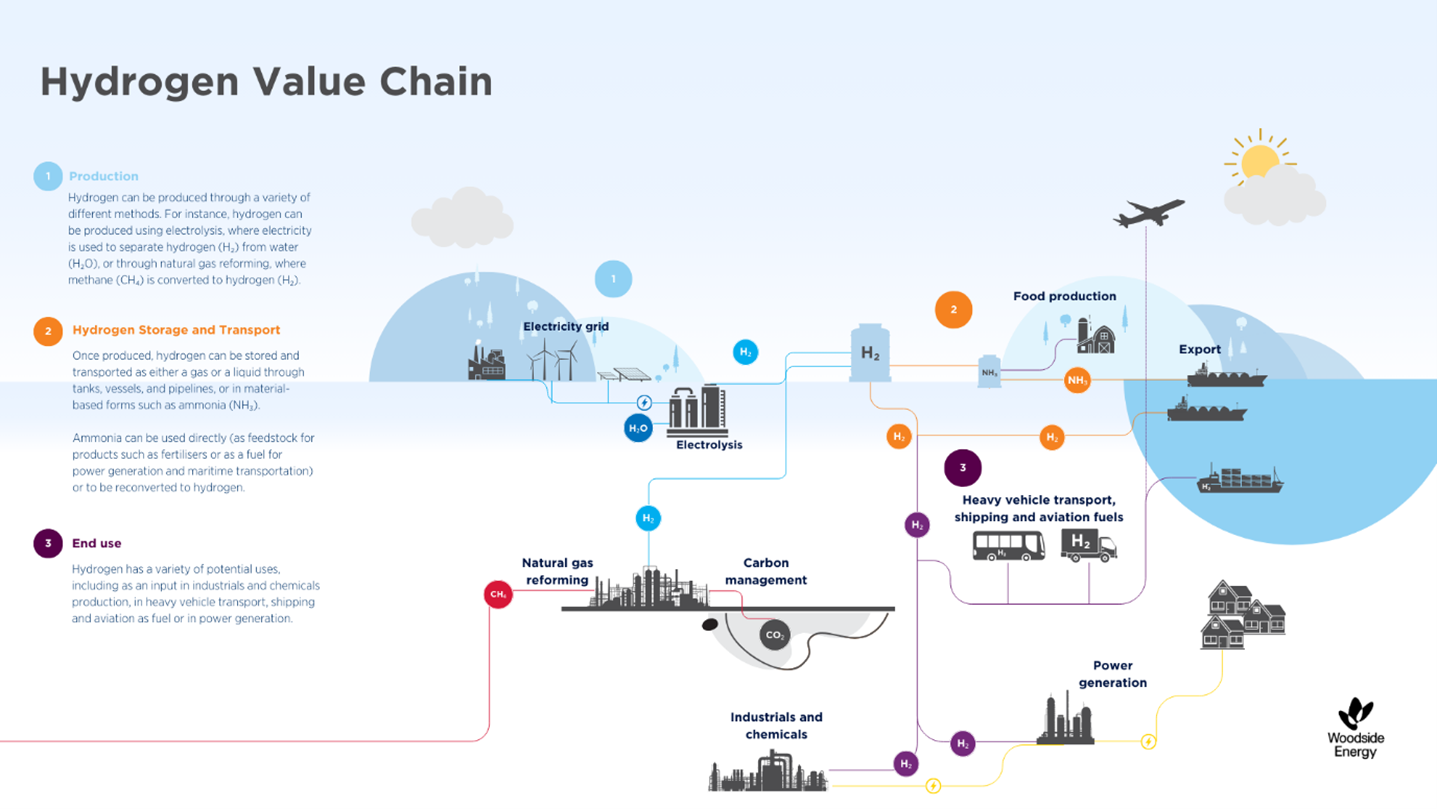

How can we make hydrogen?

We are developing new energy and lower carbon solutions - like hydrogen - that will be part of our future. Our principles for hydrogen development are:

customer led;

technology agnostic; and

lowest cost.

We are looking at opportunities for both hydrogen from natural gas with process emissions abated, and hydrogen produced using renewable energy.

The majority of hydrogen available today is produced through a process called steam-methane reforming (SMR):

- Start with natural gas, which is largely made up of methane (containing four hydrogen atoms in each molecule).

- The gas is reacted with high-temperature steam to release the hydrogen.

- CO₂ is also produced as part of the natural gas reforming process, however, technologies such as carbon capture and storage, where the CO₂ is captured and transported underground for safe and permanent storage, can assist in managing this.

Hydrogen can also be produced from renewable power sources, such as wind, solar, hydro, or geothermal.

- The renewable energy powers electrolysers, which split water into hydrogen and oxygen atoms.

- No carbon dioxide is produced.

.tmb-v2%20related.jpeg?sfvrsn=f63d2d06_1)